Table of Content

Therefore, an agent in this situation is able to highlight all the best developments currently on the market and find one best suited to your criteria and needs. In most instances, the builder — and not the borrower — receives money directly from the lender when it is time to, say, lay the foundation, complete the roof or install plumbing. During the so-called draw period, the borrower is only required to make interest payments and only on the money already released. Financing a new construction home is not unlike financing a resale home. A lender cannot close on a new construction home loan until the property is ready for you to move in. That means that you must time your application with the builder’s schedule carefully and hope that they don’t run too far beyond their projected deadline.

If you are buying in a large-scale development, which is where most new houses in the nation are located, you’ll typically need what is called a new-construction mortgage. In order to claim a home, a homebuyer applies for a mortgage early — sometimes before construction even begins — presenting the builder with a proof of a loan pre-approval. Builders often have an agent on site and preferred lenders, and it’s not uncommon for them to suggest buyers just use their team.

Good Questions to Ask a Home Builder When Buying New Construction

New homes still need professional inspections after they've been built. Even if your builder has been completely transparent throughout the process, your homeowner's insurance application and any bank financing will go smoother with a thorough inspection. There may still be hidden flaws or defects, despite the builder's reputation. Many new construction homes are sold as part of subdivision development, with parcels of land for sale. Landowners selling these tracts tend to make them as small as possible, meaning close quarters with your neighbors. Determining where to build your home affects everything from your commute to property taxes.

You’ll get more insight into the customization process and learn about any potential issues. The Home Buyers Plan allows Canadian homebuyers to withdraw up to $35,000 from their RRSPs to help fund a first home purchase. See if you qualify as a first-time home buyer, find government help and get tips for choosing the right mortgage. Since everything is new, it’s unlikely you’ll need to replace anything for a few years. It’s worth asking if you can change the layout or add different things such as more electrical sockets or pot lights. Even if it’s not included on their price list, it may still be available at a cost.

What is a new-build or pre-construction home?

You should be looking at the layouts of the room and the size of the property. If it’s a preconstruction townhouse, look into HOA and maintenance fees. Buying a new construction home isn’t quite the same as buying a pre-owned home. Still, it’s scary buying a new home while your existing one is still on the market. While most builders will accept contingencies for spec homes, they may complicate matters in custom builds. If you want to make sure you sell your existing home before closing on your new one, Orchard can make the process painless and eliminate the need for complicating contingencies.

Currently, about one-third of all homes for sale are newly built and are often a boon to homebuyers who’ve been struggling in hot markets to find pre-existing properties at an affordable price. Buying a new construction home is similar to buying a resale home, with slight differences. If you’re considering purchasing your first or next house, it’s essential to be familiar with it.

First-Time Home Buyer Guide

Since this is a new build, you’ll usually be able to choose specific items, such as the colour of your cabinets and your kitchen countertops. What you’re able to customize depends on what the builder is offering. This step takes place with your builder’s design expert or team, and is usually split up over several sessions since it can be hard to make all of these decisions at once. Note that you’re not going to know how everything looks together until your house is complete. You need to make these decisions carefully and with a vision for what you’re trying to achieve.

You can start by asking friends and family for their real estate agent recommendations. Interview more than one agent and ask each one about their experience with new-home construction. The levels of customization vary based on the builder you work with and where you plan to build. If you buy a lot in a neighborhood already owned by a developer, you may be limited in the type of home you can build. The builder may set the plans for the house on that specific lot, but you could still customize the interior to your liking. Look at builders and construction companies in the area and nationally.

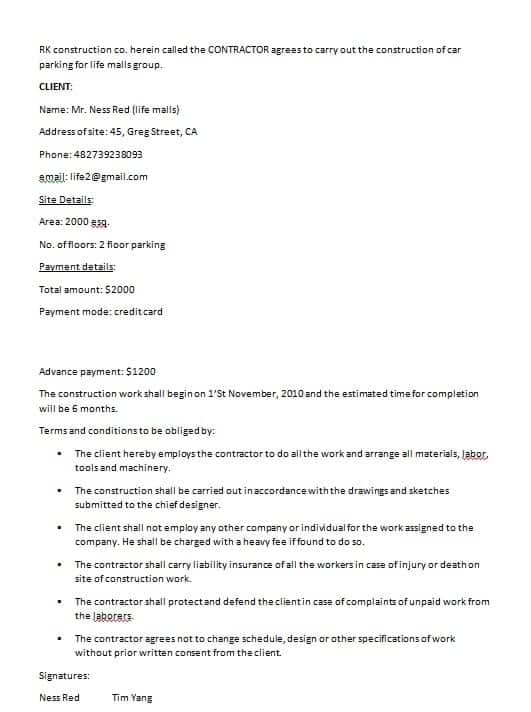

This deposit is usually nonrefundable, so you’ll want to be certain you're ready to move forward with that particular builder. For example, while some lenders will allow a 3.5% down payment for a conventional mortgage, you may have to put down 20% of the estimated costs for a construction loan. Start by finding a lender that offers construction loans — not every lender does.

If your custom home meets not only your needs but also the needs of a larger pool of buyers, it will sell faster several years down the road. Your area's Home Builder's Association will have a list of home builders in your area. Be sure to interview your potential builders, including checking references and touring past projects. Some state laws actually require the involvement of a real estate lawyer. You don’t have to hire an agent to buy new construction, but you may want to consider doing so anyway.

This warranty will state the length of the warranty and how the homeowner should dispute issues. Whether there are simple cosmetic oversights or significant issues with something not being built to code requirements, you’ll want to protect yourself with a home inspection. You also have the option of purchasing a piece of land in an area you like and look for a reputable builder who could build a house on that plot. Property taxes may also be higher in certain counties than in others, which may be a factor worth considering and is one your real estate agent can help you figure out. Spec homes are a great option when you want the never-been-used thrill of a new property, but perhaps do not have several months to wait for a house to be built from scratch. You could opt to skip the home inspection as a negotiating tactic.

A good real estate agent will know about new developments in your area. Some builders pick up lots and build one or two homes at a time. So keep an eye out for new places under construction in your target neighborhood and ask your agent to contact the contractor or developer. Construction loans, on the other hand, are meant for custom homes, where the homeowner works with a builder and a lender to purchase a plot and erect a house. During the building process, which can take up to a year or more, the homeowner carries this type of loan.

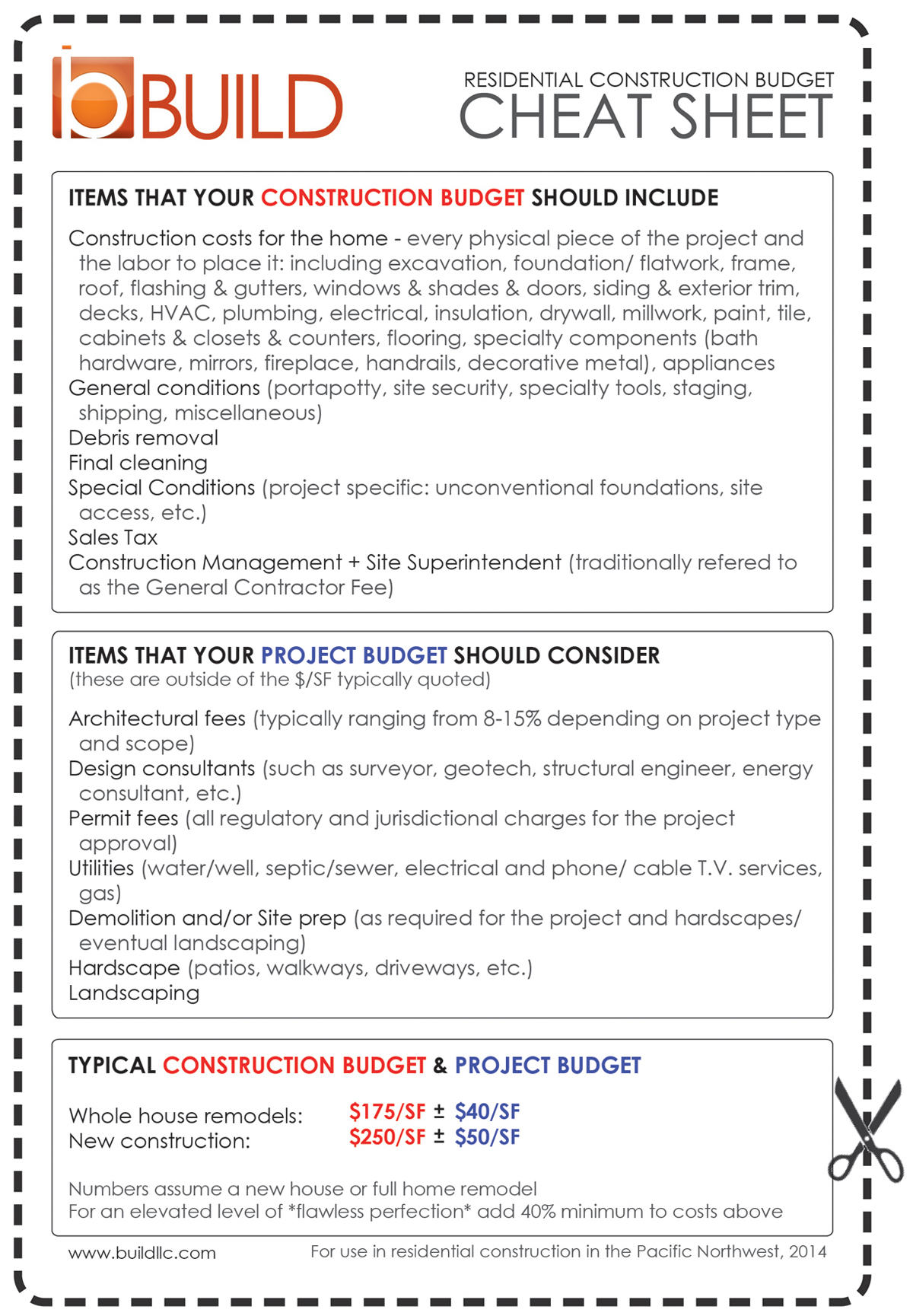

They come with a lot of perks, like energy efficiency and no worn-down parts in need of repair—plus, you can make it exactly the way you want it. But there are few things to think through when it comes to new construction, like budget and timing. Here are a few of the big things to consider when deciding if new construction homes are right for you. Costs will vary by region, with higher costs in urban areas than suburban or rural areas. It’s also easy to get carried away by upgrades that can significantly add to the price of the home.

Through February, housing starts were 6.4% higher year-over-year and new construction homes made up 14% of all single-family sales. If the pandemic-induced housing shortage has made finding your dream home feel impossible, new construction may be an answer. For example, Wolf says if the headline mortgage rate is 5%, a builder might be able to offer a loan as low as 3.9%. “With new and modern plumbing, electric, appliances, heating and cooling systems, new-construction homes provide the potentially significant financial benefit of low-maintenance costs,” says Little. Some builders also offer longer-term warranties, such as ten years or more. These warranties usually cover significant appliances, such as the furnace and water heater.

No comments:

Post a Comment